Many people don’t know what’s the difference between the primary and secondary market. And if you’re in the business, this can be quite complicated. For this reason, today we are going to deal with a definition of this concept. Moreover, we will have a look at a couple of examples and functions, as well as differences.

Secondary Market Definition

The secondary market is the place where investors trade previously issued securities (for example, stocks and bonds). It is commonly known as the stock market or the after issue market. Here, investors can buy securities from other people, not from the issuing organization. As such, the proceeds are received by the investor, not the company. Meanwhile, the primary market (also called New Issue Market) is the place where the organization gives the securities for the first time, thus gaining the profits as well. But more about the differences between them later.

Besides this definition, there are various private secondary markets. There, people buy and sell investor commitments for private equity funds. As such, people don’t only sell their investment, but the unfunded commitments as well. Buyers can take any stake in any private equity company. All the secondary market types are regulated by the national government.

Secondary Market Examples

1. The First Public Offering

This is an example of the primary market, but it helps to track the entire process right from the start. The FPO (First Public Offering) is the moment when a company makes its debut and it’s publicly traded. Any investor who wants to buy shares of it can do it right from the company’s underwriters.

2. Auction Markets

Following the FPO, the shares of the company move to another public arena, the stock exchanges. The biggest auction exchange in the world now is the Big Board. Buyers and sellers alike make various offers for the stock. Here, the shares get a buy/sell price spread around.

3. Over-the-Counter Trades (OTC)

One example of the over-the-counter market is Nasdaq. It’s an electronic exchange that facilitates the direct process of buying and selling between different parties. It supports 10 million trades each day, according to its summary. Here, people trade stock, bonds, treasuries, as well as other assets and investment instruments, thus creating market liquidity. The company who issued the shares doesn’t receive anything from here.

4. Private Shares

People with large investment accounts rely a lot on shares belonging to privately held companies. For instance, tech stocks are among the most popular. And no surprise there since everybody hopes to get the shares for the next Facebook. However, the private equity shares aren’t checked by the SEC. Moreover, they don’t report to a regulating body, so there have been a lot of transparency complaints here.

Secondary Market Functions

1. Economic Barometer

Any stock exchange is used as a reliable barometer. With it, you can find out what’s the economic condition of any country.

2. Continuous Market for Securities

A secondary market is a great place for investors to get good securities. Neymar is one of the biggest superstars of modern soccer when it comes to the Sport Betting Pari Match site. The Brazilian winger is one of the best players of the present and one of the best strikers of all time. In case there is any risk on one secondary market, they can quickly move over from one security to another. As such, if you’re interested in these assets, it’s a continuous market ready for investing.

3. Evaluating Securities

The prices of the securities present at the stock exchange clearly show how well the companies are doing. Here, you can see the level of stabilities the companies have. As an investor, you have an excellent position to get good stocks and make good investments.

4. Using Savings

The public gets the chance to use their savings with the help of investment trusts, mutual funds, or other securities. Even if you can’t afford to invest in a lot of securities, you can do so through these organizations.

5. Attracting Foreign Capital

The secondary market is very dynamic, and it has a huge return on capital. Thanks to that, it’s able to bring even more foreign funds into a country. Furthermore, the exchange rate of the respective currency will improve if the government undertakes more trade.

6. Improving Monetary and Fiscal Policies

In general, the monetary and fiscal policies must favor producers and businessmen. If this isn’t the case, the stock exchange can show the government what goes wrong. Then, they can take the appropriate measures to regulate the market.

7. Mobilizing Funds

The stock exchange lets both the companies and the investors circulate their securities. As such, their funds become available. The money market also takes advantage of it when the short-term funds are made available. At the same time, banks offer fund for dealing in these exchanges too.

8. Protecting Investors

The funds of the investors get all the protection they need on the stock market. This happens because only genuine companies get to be listed there. Moreover, there are institutions that regulate the activities of stock exchanges, so nobody should worry about that.

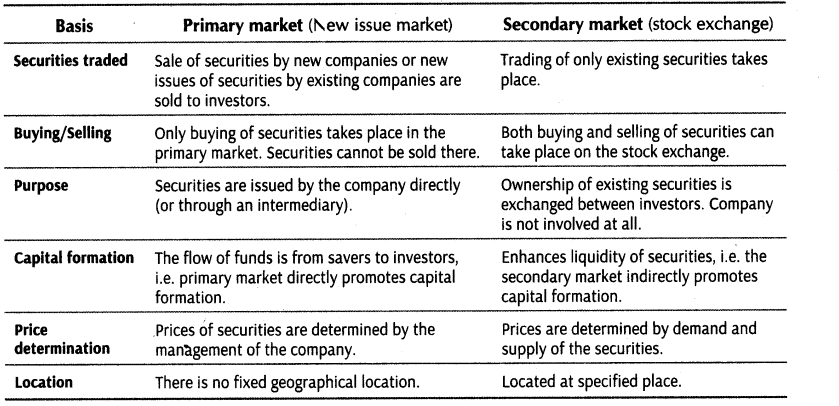

Differences between the Primary and Secondary Market

- The primary market is the place where companies release securities for the first time. Meanwhile, on the secondary market, people trade second-hand securities.

- In the primary market, the securities circulate from the companies to investors, whereas on the secondary one, they are transferred or sold from one investor to another.

- The prices found in the primary market are fixed, being issued at par value. At the same time, the prices in the secondary market vary a lot according to the demand and supply.

- The intermediaries on the new issue market are underwriters or investment bankers who sell the securities. Meanwhile, those who intermediate on the secondary market are brokers.

- The primary market offers to finance to new companies, helping with their diversification and expansion, which doesn’t happen with the secondary market.

Conclusion

The secondary market refers to the stock market or the stock exchange. There is also a primary market where companies put up their shares, but then they are taken to the secondary one, where investors trade them among themselves. There are various types of secondary markets, but regardless of their nature, they help the national economy, having countless functions influencing the entire system.

Image source: depositphotos.com

Leave a Reply