Many Americans choose to make a charitable donation for various reasons. Among the most popular ones you can find making a nice gesture towards other people, but also cutting down on your tax burden in the respective year. As it seems, most people would reduce the amount they give if the corresponding tax deduction would also decrease. Because it’s such a compelling reason to make charitable contributions, today we are going to find out more about the topic.

Charitable Contributions Definition

Simply put, charitable contributions refer to gifts given by an individual or an organization to a charity, nonprofit organization or a private foundation. Usually, it comes in form of cash, but there can also be non cash charitable contributions, such as clothing, real estate, motor vehicles, other services, assets, etc.

Often, this type of donations is the main source of funding for a lot of charitable organizations, as well as nonprofit organizations. In most countries, including the U.S., such a gesture attracts an income tax deduction.

Charitable Contributions Basics

You must know that not all organizations are eligible for tax-deductible donations. This is something you should be informed about beforehand. Of course, most of the major religious groups and charities are on that list, but in case you want to donate to a small group, you should check if that counts. Consult the official list of the tax-deductible contributions on the official website of the IRS.

Alternatively, you can ask the organization for the IRS determination letter or call the authority at 1.877.829.5500. An important thing to keep in mind is that you can’t deduct donations made to foreign charities. You can still do that if the foreign charity has an American branch, for example.

Maximums for Donations

Naturally, charities will appreciate your donations as small or large as they are. However, the IRS imposes some a charitable contribution deduction limit on the amount taken from your taxes. If you offer 20% or less of your AGI to charity, you don’t have to worry about maximums. However, in other cases, you might deduct a contribution that totals half of your AGI. Even so, the limit is cut down to 20% or 30% for certain organizations or for donating some types of property. For more information on maximums, you should check the IRS Publication 526, charitable contributions section.

A good thing you should keep in mind about donations is that if you give away more than the deduction limit, you can keep the extra part and carry it over to the next year. As such, you can deduct your taxes for the next year as well, and this is called charitable contributions carryover.

Deductibility Codes

These are a couple of directions and instructions instated by the IRS to organize the type of donations. Some of the official deductibility codes are:

- PC – public charity, 50% limit of deductibility;

- POF – private operating foundation, 30% deductibility limitation;

- PF – private foundation, 30% limitation;

- GROUP – central organization with a group exemption letter, limitation varies; etc.

There are plenty of such codes, and before making a large contribution you should check out the IRS database. Thus, you can find out if there are any special rules that apply to your contribution.

How to Handle the Tax Deductions

The Process

The first step you need to take if you want to deduct your charitable contributions is to itemize the deductions. Make sure that the itemized deductions amount to less than the standard you are eligible to take. If you decide to itemize, you need to fill out the Form 1040 and then itemize the deductions on Schedule A. Then, simply follow the instructions to claim your contributions.

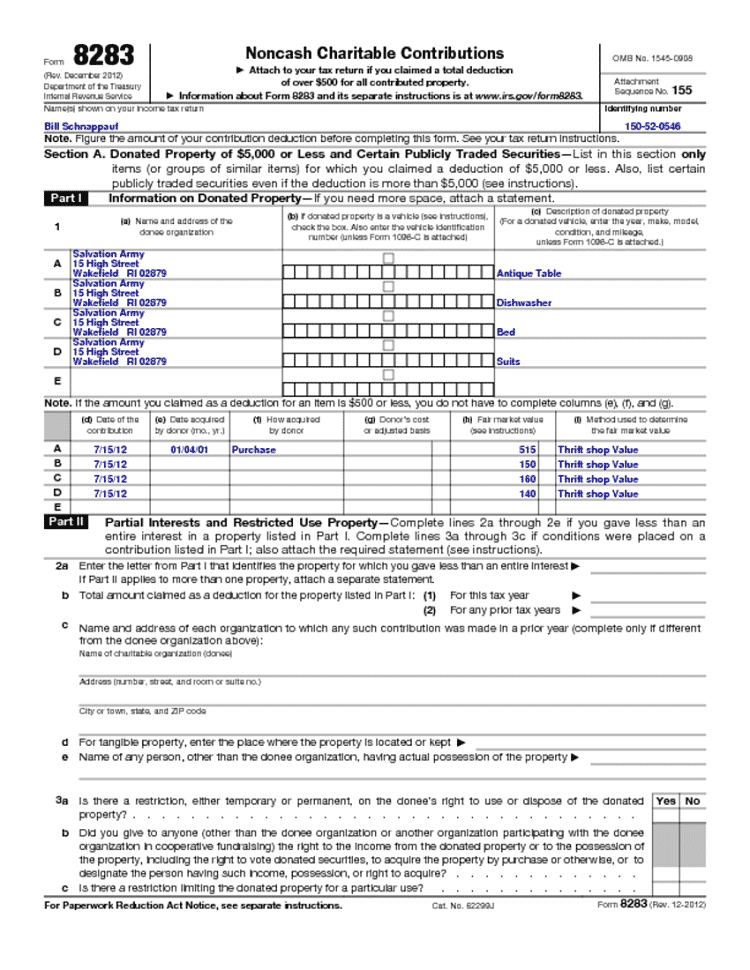

For non-cash donations that amount to more than $500, you need to use the charitable contributions Form 8283, where you must list what you donated, to whom, and how much was it all worth.

Tips and Tricks

1. Don’t Make Donations to Individuals

What you need to remember is that the charitable contributions made to individuals don’t count. For example, you can’t get a tax deduction if you handed out money to the homeless, if you collect money at the office or the neighborhood, etc. In case you still want to do it and get a tax deduction, a good idea is to donate to the Red Cross organization, for example.

2. Never Forget to Get a Receipt

Regardless of the amount you give away, any cash deduction needs to be backed up by a bank record. For example, you can use a canceled check or credit card receipt, on which you write down clearly the name of the charity. The organization can also provide you with a receipt in writing. Here’s what you need to have on the writing:

- The date;

- The amount;

- The organization that received the donation.

As such, remember to always ask for a receipt. Any charity of good will can give you one. Pay attention! You don’t need to submit this document together with your tax return, but you might need it for the audit.

3. Payroll Deductions Count Too

Many people don’t know about this, but employees can use the opportunities for charitable giving provided by their employer. If you contribute through a payroll deduction, you should have a pay stub showing the total amount that was withheld. Moreover, there should also be a pledge card showing the name of the charity. In case you don’t know much about this, check the Pension Protection Act of 2006, which requires your employer to keep a record of it all.

4. Think of Donating Appreciated Assets

If you decide on donating property that was appreciated in value, just like stock, you can double your benefits. On the one hand, you can deduct the fair market value the property has if you owned it at least for 12 months. On the other, you will avoid paying any capital gains tax. Usually, the capital gains tax applies to appreciated property, but charitable contributions make an exception.

Conclusion

Charitable contributions are a great idea if you want to help people and deduct your taxes at the same time. However, things aren’t as easy as it seems. There are still some limits and regulations, so you need to be well informed before applying for a tax deduction at the end of the year.

Image source: depositphotos.com

Leave a Reply